LKR Agent guest post by Julie Dancer

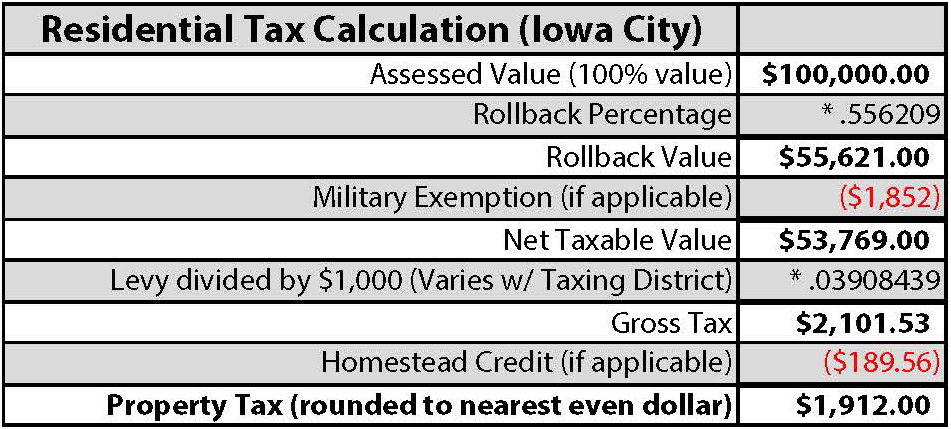

Understanding your tax liability is an important factor when purchasing a home. Use the sample calculation to learn how current tax rates affect how much you pay each year.

Below you will find the tax levies for Johnson County. These rates will be used in the computation of property taxes payable in FY’19, due September 1, 2018 and March 1, 2019 (based on 2017 assessments). The levies on the enclosed schedule are represented in dollars per $1,000 valuation. You may also view the current levy rates on the Johnson County Auditors web site at: http://www.jcauditor.com.

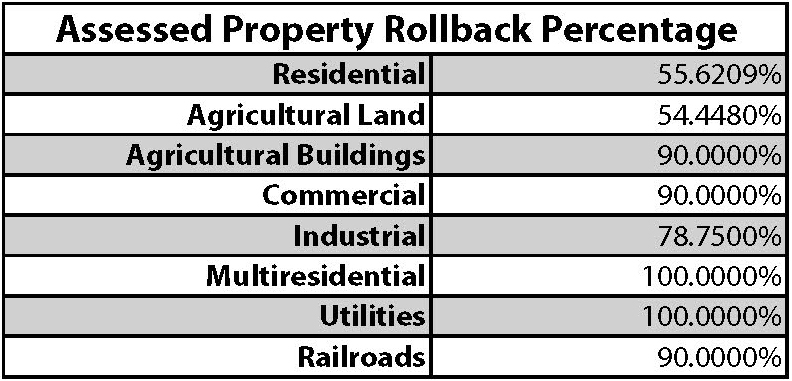

The assessed value of property will be rolled back as follows:

Below is an example of a typical residential tax calculation for Iowa City.

*Note: Levy amount varies with taxing district – view PDF for rates

Please contact the Johnson County Auditors office at (319) 356-6004 if you have any questions or comments about your property taxes.

This post originally appeared on JulieDancer.com.